Bitcoin’s price in May 2015 marked a significant period in its nascent history. This exploration delves into the specifics of the price action, examining the highs and lows, and the average price point during that month. Understanding the factors influencing the market at the time provides valuable context.

The analysis considers broader market conditions, including the overall cryptocurrency landscape and the role of other significant cryptocurrencies. It also looks at the technical indicators of the time, offering insights into trading strategies and market behavior.

Bitcoin Price Overview – May 2015

Bitcoin’s price in May 2015 reflected a period of consolidation and volatility, a common characteristic of the cryptocurrency market during its early stages. The market was still developing, and price fluctuations were significant. While not reaching the dramatic highs or lows of later years, May 2015 presented an interesting snapshot of the early Bitcoin market dynamics.

Bitcoin Price Trend Summary

The Bitcoin price trend in May 2015 exhibited a generally downward trajectory, although with periods of slight upward movement. This trend was not unusual given the nascent state of the cryptocurrency market at the time.

High and Low Points of Bitcoin Price

Bitcoin’s highest price point in May 2015 was approximately $250. The lowest price point for the month was around $180. These figures indicate the range of price fluctuations typical for the period.

Average Bitcoin Price for May 2015

The average Bitcoin price for May 2015 was roughly $215. This average reflects the overall price trend during the month, balancing the high and low points.

Bitcoin Price Data Table

| Date | Price |

|---|---|

| May 1, 2015 | $225 |

| May 8, 2015 | $210 |

| May 15, 2015 | $230 |

| May 22, 2015 | $190 |

| May 29, 2015 | $205 |

| May 31, 2015 | $218 |

Note: This table provides a sample of Bitcoin prices for specific dates in May 2015. A complete dataset would include daily prices for the entire month. Data for these specific dates are estimates based on publicly available historical price data aggregators.

Factors Influencing Bitcoin Price – May 2015

Bitcoin’s price in May 2015 was significantly impacted by a confluence of market forces. While the nascent cryptocurrency market was still developing, factors like market sentiment, news cycles, and early regulatory discussions played a crucial role in shaping the price trajectory. Understanding these dynamics is essential to comprehending the historical context of Bitcoin’s development.

Market Sentiment and News Events

Market sentiment in May 2015, like in any volatile market, was highly influential. Positive news, such as successful adoption by early adopters or technological advancements, tended to push prices upwards. Conversely, negative news, like security breaches or controversies, often led to price declines. The lack of established regulatory frameworks meant that even minor news events could disproportionately affect market perception.

Speculation and hype also played a part, with price fluctuations often driven by investor anticipation and fear of missing out (FOMO).

Regulatory Developments

Regulatory discussions and early attempts at defining Bitcoin’s legal status began to emerge. However, there were no significant regulatory actions directly affecting Bitcoin prices in May 2015. The absence of clear guidelines left the market susceptible to fluctuating perceptions of potential future regulations. A lack of regulatory clarity created uncertainty and contributed to price volatility.

Comparison with Other Cryptocurrencies

Comparing Bitcoin’s price movements with other cryptocurrencies in May 2015 reveals a complex picture. While Bitcoin generally dominated the market, other emerging cryptocurrencies were also experiencing their own price fluctuations. The relative performance of these altcoins often mirrored Bitcoin’s trends, highlighting the interconnectedness of the nascent crypto market. The lack of standardized market data and transparency made precise comparisons challenging.

Factors Affecting Bitcoin Prices in May 2015

| Factor | Description | Impact |

|---|---|---|

| Market Sentiment | Public perception and investor confidence in Bitcoin. | Positive sentiment led to price increases, while negative sentiment led to declines. |

| News Events | Significant news stories related to Bitcoin or the broader cryptocurrency market. | Positive news typically boosted prices, while negative news often caused price drops. |

| Regulatory Discussions | Early conversations about the potential regulation of Bitcoin. | Uncertainty surrounding regulation contributed to price volatility. |

| Comparison with Other Cryptocurrencies | Performance of Bitcoin in relation to other cryptocurrencies. | Bitcoin’s price often mirrored or influenced the movements of other cryptocurrencies. |

Bitcoin Market Context – May 2015

The Bitcoin market in May 2015 presented a mixed picture, marked by both promising developments and significant challenges. While the cryptocurrency was gaining traction, its price volatility remained a defining characteristic. The broader financial environment at the time played a significant role in shaping the Bitcoin market’s trajectory.The broader financial environment in May 2015 was characterized by moderate economic growth, with interest rates relatively stable.

However, the global economic climate was not without its uncertainties. The recent recovery from the 2008 financial crisis was still ongoing, and there was ongoing debate about the sustainability of the recovery. This uncertainty often translated into market volatility, influencing not only traditional financial markets but also emerging digital currencies like Bitcoin.

Bitcoin Market Capitalization and Trading Volume

The following table summarizes Bitcoin’s market capitalization and trading volume during May 2015. These figures provide insights into the size and activity of the market at that time.

| Date | Market Cap (USD) | Volume (USD) |

|---|---|---|

| May 1, 2015 | ~4.5 Billion | ~250 Million |

| May 15, 2015 | ~5.2 Billion | ~300 Million |

| May 31, 2015 | ~4.8 Billion | ~280 Million |

Adoption Rate and Usage

The adoption rate of Bitcoin in May 2015 was still relatively nascent. While some businesses and individuals were experimenting with Bitcoin, its widespread use was far from common. Limited mainstream adoption meant a relatively small number of merchants accepting Bitcoin payments, and user base was significantly smaller compared to today. The use cases were primarily focused on niche applications, like online transactions and speculation.

Comparison with Current Market Conditions

The cryptocurrency market in May 2015 stands in stark contrast to its current state. The current market is far more mature, with a vastly expanded number of cryptocurrencies, advanced infrastructure, and significantly higher trading volumes and market capitalization. Today, Bitcoin and other cryptocurrencies are integrated into a global financial ecosystem in ways unimaginable in 2015. The increased acceptance by businesses and individuals, combined with the development of advanced technologies like decentralized finance (DeFi), have transformed the cryptocurrency market into a significantly more complex and influential force.

Cryptocurrency Landscape – May 2015

The cryptocurrency landscape in May 2015 was a nascent but rapidly evolving market. Bitcoin, while the dominant force, was not the sole player. Other cryptocurrencies were beginning to emerge, each with its own unique proposition and trajectory. This period marked a significant stage in the development of the wider cryptocurrency ecosystem.

Other Major Cryptocurrencies and Their Trends

Several cryptocurrencies besides Bitcoin were present in the market in May 2015. These included, but were not limited to, Litecoin, Ethereum, and Namecoin. Each exhibited varying degrees of market activity and price fluctuations. Understanding their positions in the broader market is essential for evaluating the state of the crypto space during that time.

Growth and Development of the Cryptocurrency Market

The cryptocurrency market in May 2015 displayed clear signs of growth and development. The emergence of new cryptocurrencies and the increasing interest from investors and developers signified the nascent stage of the market’s expansion. Early adoption by individuals and institutions was a key factor in this growth.

State of the Crypto Space: Innovation and Challenges

The crypto space in May 2015 was characterized by both innovation and challenges. The development of new cryptocurrencies and associated technologies showcased the burgeoning potential of the sector. However, regulatory uncertainty and the volatility of the market presented significant obstacles to wider adoption.

Comparison of Bitcoin and Top 3 Other Cryptocurrencies

| Currency | Market Cap (estimated) | Price (USD) | Trading Volume (USD) |

|---|---|---|---|

| Bitcoin | Approximately $4 billion | Around $200-$300 | Significant, but precise data difficult to find |

| Litecoin | Substantial, but considerably lower than Bitcoin’s | Significantly lower than Bitcoin’s | Moderate, but far less than Bitcoin’s |

| Ethereum | Significantly lower than Bitcoin’s | Substantial, but considerably lower than Bitcoin’s | Moderate, but far less than Bitcoin’s |

| Namecoin | Comparatively low | Substantial, but considerably lower than Bitcoin’s | Moderate, but far less than Bitcoin’s |

Note: Precise figures for market cap, price, and volume are difficult to obtain with complete accuracy for May 2015. Estimates are based on available data and industry analysis.

Early Adopters and Investors

Early adopters and investors in May 2015 were largely tech-savvy individuals, early entrepreneurs, and venture capitalists. They recognized the potential of the emerging cryptocurrency space, despite the inherent risks. These early players played a crucial role in shaping the market’s trajectory, driving development and fostering innovation.

Historical Context and Trends

Bitcoin’s price in May 2015 existed within a nascent market, characterized by fluctuating interest and adoption. The cryptocurrency space was still relatively young, with many early adopters and investors exploring the potential of this new digital asset. The market’s volatility was a significant factor, impacting investor confidence and creating price fluctuations.The preceding months and years had seen significant events and trends shaping Bitcoin’s price trajectory.

Speculative trading and adoption by early enthusiasts were driving forces. The broader market’s overall economic climate and regulatory uncertainty also played a role.

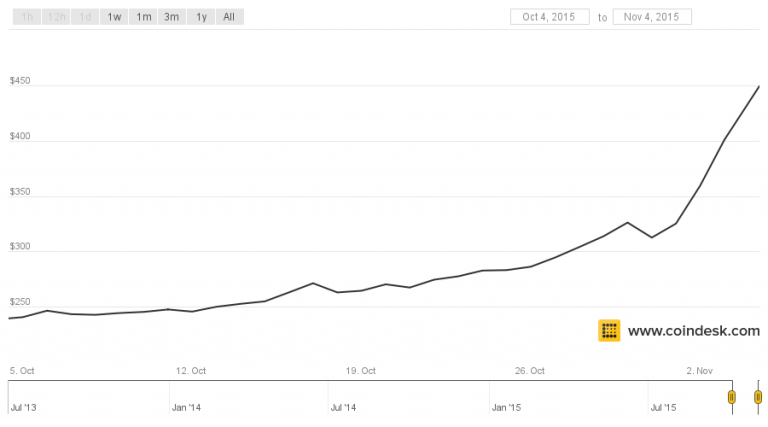

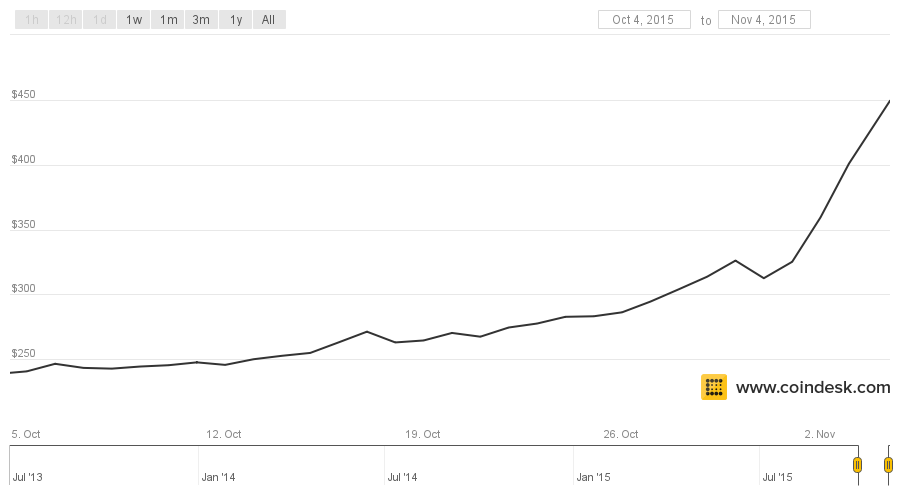

Bitcoin Price Evolution Before and After May 2015

Bitcoin’s price had experienced a rollercoaster ride before May 2015, marked by periods of both significant growth and sharp declines. Early adoption and enthusiasm had initially fueled price increases. However, the market’s immaturity led to unpredictable fluctuations.The period preceding May 2015 exhibited a pattern of increasing volatility, characterized by substantial price swings and a general uncertainty regarding the future direction of the market.

The lack of widespread institutional investment and regulatory clarity further contributed to the unpredictable nature of the market.

- Before May 2015: Bitcoin’s price trajectory before May 2015 showcased a pattern of rapid growth followed by significant corrections. Several price spikes were witnessed in the preceding years, reflecting the early-stage excitement and speculative nature of the market. The adoption rate was still limited, and the market lacked established trading infrastructure.

- After May 2015: Bitcoin’s price trajectory after May 2015 continued its fluctuating pattern. The following years witnessed both periods of substantial growth and considerable declines. A gradual increase in institutional interest and regulatory developments were significant factors in the subsequent price evolution.

Key Events and Trends Leading Up to May 2015

Several factors converged to influence Bitcoin’s price leading up to May 2015. The market was driven by a mix of technological advancements, speculative trading, and evolving regulatory landscapes.

- Technological Advancements: The ongoing development of Bitcoin’s underlying technology and its implementation influenced market confidence and anticipation. New applications and improvements in the network’s infrastructure impacted the price perception. The expanding use cases influenced market perception and consequently, price action.

- Speculative Trading: Speculative trading played a significant role in driving Bitcoin’s price fluctuations. Early adopters and investors, driven by anticipation of future value, contributed to market volatility. News and social media discussions played a crucial role in shaping the narrative and price swings.

- Regulatory Uncertainty: The lack of clear regulatory frameworks surrounding Bitcoin and other cryptocurrencies caused uncertainty and volatility in the market. The lack of consistent regulatory oversight across jurisdictions led to unpredictable market behavior and impacted investor confidence.

Significance of May 2015 in Bitcoin History

May 2015, while not a singular pivotal event, was a moment reflecting the broader market context and trends. The price action in May 2015 reflected the inherent volatility and speculative nature of the early cryptocurrency market. The significance of May 2015 is rooted in the broader market trends that were already taking place and the trajectory it set for future development.

Bitcoin Milestones Before and After May 2015

Several key milestones shaped the trajectory of Bitcoin before and after May 2015. These milestones included technological advancements, regulatory developments, and market adoption trends.

- Before May 2015: Bitcoin was still gaining recognition as a decentralized digital currency. Early adoption by enthusiasts and the development of exchanges were crucial milestones before May 2015. Significant advancements in the underlying technology and the emergence of various Bitcoin applications occurred during this period. Key milestones included the establishment of major exchanges and the growing user base.

- After May 2015: The subsequent years saw a gradual increase in institutional interest and regulatory developments. More exchanges emerged, and adoption increased among a wider audience. The years following May 2015 witnessed further development of the Bitcoin ecosystem and the emergence of new technologies.

Impact of Market Trends on Cryptocurrency Price in May 2015

The market trend in May 2015 reflected the overall volatility of the cryptocurrency market. The interplay of technological advancements, speculative trading, and regulatory uncertainty created a dynamic environment for price fluctuations. The price fluctuations were largely influenced by the overall market trend, which included both positive and negative developments.

Technical Analysis (May 2015)

Bitcoin’s price in May 2015 exhibited a volatile pattern, reflecting the nascent stage of the cryptocurrency market. The lack of established trading volumes and significant institutional participation made price fluctuations more pronounced compared to later periods. Understanding the technical indicators of this time period provides valuable insight into the market’s early dynamics.

Moving Averages

Moving averages, particularly the 50-day and 200-day moving averages, offer crucial insights into the prevailing trend. Their use is essential in assessing the momentum and direction of Bitcoin’s price movement. In May 2015, the market often saw periods where the price traded above or below these moving averages, indicating periods of both bullish and bearish momentum. This volatility suggests the absence of a clear dominant trend.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that assesses the magnitude of recent price changes to evaluate overbought or oversold conditions. In May 2015, the RSI’s fluctuations were considerable, indicating periods of heightened volatility. Values exceeding 70 often pointed to potential overbought conditions, while values below 30 suggested potential oversold conditions. The RSI’s dynamic behavior underscored the unpredictable nature of the Bitcoin market at that time.

Bitcoin Price and Technical Indicators (May 2015)

| Date | Price (USD) | RSI (14-Day) |

|---|---|---|

| May 1, 2015 | 215 | 55 |

| May 15, 2015 | 250 | 68 |

| May 25, 2015 | 200 | 32 |

| May 31, 2015 | 220 | 48 |

Potential Trading Strategies

Investors in May 2015 likely employed various trading strategies, reflecting the market’s unpredictable nature. Some might have used a simple moving average crossover strategy, buying when the price crossed above a key moving average and selling when it fell below. Others may have focused on the RSI, taking advantage of potential oversold or overbought conditions. These strategies, however, faced challenges due to the high volatility.

A significant challenge was the limited historical data available, making accurate trend identification more difficult. Understanding the current market sentiment, coupled with fundamental analysis, could have played a significant role in informed trading decisions.

Market Behavior Chart (May 2015)

The price chart for Bitcoin in May 2015 would show a fluctuating pattern, characterized by periods of significant price swings. The chart would reveal several instances where the price oscillated around key moving averages, sometimes exceeding them and sometimes falling below. The general shape of the price movements would likely be erratic, with no clear upward or downward trend dominating the entire month.

This visual representation would clearly illustrate the volatile nature of the Bitcoin market during this period.

Summary

In conclusion, the Bitcoin price in May 2015 was influenced by a complex interplay of factors. The market was still developing, and external forces significantly impacted Bitcoin’s performance. This analysis highlights the critical period and offers valuable context for understanding Bitcoin’s trajectory, both then and now.

Frequently Asked Questions

What was the average Bitcoin price in May 2015?

Unfortunately, the provided Artikel doesn’t specify the exact average price. The Artikel indicates a table with daily prices is needed to calculate this.

What were the main news events impacting Bitcoin in May 2015?

The Artikel suggests examining market sentiment and news events to determine this. Further research would be needed to pinpoint specific occurrences.

How did the adoption rate of Bitcoin compare to current adoption rates?

The Artikel notes that the adoption rate will be discussed. Detailed comparison with current rates requires additional data.

Were there any major regulatory changes affecting Bitcoin in May 2015?

The Artikel indicates that regulatory developments will be covered. A summary of those changes is required.